JJ BAS PREPARATION - UPDATED MAY 2016- xxxxxxxx

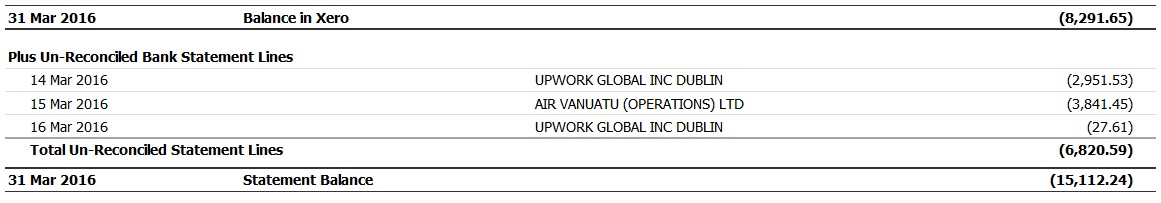

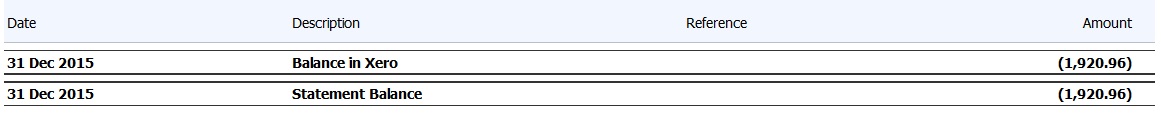

- Check that all bank reconciliation reports are up to date by running it for the end of the quarter. There shouldn’t be any unreconciled for the quarter you are finalising, if there are you need to reconcile these items.

- Confirm that the bank balance in Xero agrees to the bank account. Confirm the closing balance as at end of quarter.

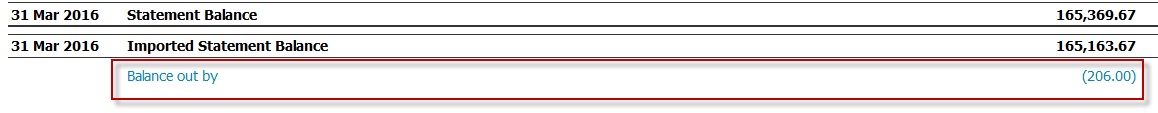

- Check that there isn’t an out of balance amount at the bottom of the bank reconciliation report. This will show as a difference between the Xero balance and the imported statement balance. If you see this you need to locate the error and correct before continuing.

Run the balance sheet for period end.

Review and investigate any unusual balances.

Check all clearing account balances are $0. If they aren’t, investigate why.

Check Suspense account is $0. If not, investigate and re-code any outstanding transaction to their respective accounts.

Check that the payroll activity summary report agrees to the General Ledger report for wages, superannuation and tax.

Review the Draft sales and purchases and see whether it appears reasonable. Sometimes they don’t need to be all ‘Approved’ as they may be sitting as a Draft for a reason. Only when the invoice or bill is approved, will it get posted to the income or expense accounts.

Run an Aged Payables report to the end of the period.

Tick ‘Show invoices’

Review for outstanding items

Run a General Ledger report for the Quarter

Scroll to the bottom of the ‘General Ledger summary report’ and click on EXPORT DETAILED GENERAL LEDGER TO EXCEL,THEN GOOGLE SHEETS

This shows all the quarter’s transactions – all debits & credits, transaction type, reference, GST tax rate, cheque numbers (entered in reference field), PO numbers (on Bills), descriptions. If there are multiple line items in an Invoice or Bill, then the description for each line item will display on individual rows.

TRANSACTION TYPES ARE IDENTIFIED AS:

INV: Invoices

PAY: Payment or cash refund

MJ: Manual journal

EC: Expense claim

CN: Credit note (date of credit note)

APP: Date credit note applied to invoice

BT: Bank transfer

SB: Starting Balance

ADJ: a system-generated minor adjustment where Xero represents one payment for several invoices as individual journals, rather than one journal with multiple payments.

PR: Wage payable bill

Task: Review the General Ledger report (as exported to Excel) for consistency and accuracy.

THE GST ACCOUNTING METHOD DETERMINES THE TRANSACTIONS INCLUDED IN THE PERIOD OF THE REPORT.

Accruals will use invoice or expense claim reporting dates.

Cash will use bank transaction or invoice and expense claim payment dates.

Ensure that prior Activity Statements have been published in Xero. Xero automatically will select the next period for the from & to dates based on which BAS/IAS has already been published.

Click on Activity Statement

Enter date from & to for the date range of the period

Statement: select correct statement and click “Update”

Click on the GST Audit Report tab

Scroll right to the bottom and ‘Export’ to Excel and sort by column B for each different tax coding. This makes reviewing faster.

Review for correct GST coding, accuracy and consistency.

Once all above steps have been completed, contact the accountant to advise the file is ready for them to process the BAS.

Related Articles

PDS BAS PREPARATION - RECONCILE ACCOUNT - UPDATED MAY 2016

BANK RECONCILIATION AND STATEMENTS There are 3 bank accounts: Cheque Accounts xx8507 Visa Card PDS PayPal 1. CHEQUE ACCOUNT XX8507 For each account you need to check that all transactions for the quarter have been reconciled. For Example: Preparing ...JJ ACCOUNTS APPLICATION FOR CREDIT ACCOUNT - UPDATED MAY 2023

this guide to be updated matt 090523 Occasionally new customers will request an account application we need to balance between offering this service and extending our credit and cash flow Ideally we would not offer any accounts as is takes time to ...CHECK WITH ACCOUNTANTS - BAS PAID - PROPERTY

This is an email we send to Matthew Perfrement Accountants as a reminder to complete process and submit BAS – Bas is due quarterly. Example email including email addresses below -TELEPHONE CALLS ACCOUNTS -outbound calls- UPDATED MAY 2017

NOTE FOR ADMIN: Do not make calls during Tuesdays and Thursdays not unless the customer requested for call back or accounts are only available on those days Reminder emails are being sent Tuesdays and Thursdays so let's not make a call as well if ...REAR DIFF ASSEMBLY- General Part Guidelines - UPDATED MAY 2018

LINK TO GUIDE